Last Updated on 26.09.2024 by hrushetskyy

As a popular tire retailer, we often get asked how easy or challenging it is to open and successfully run a tire store. To cover the basics, the United Tires management team decided to create a series of articles covering different aspects of the process. We’ll give you insider tips and highlight key considerations for a prospective tire business owner. Everything from finding the right niche to effective marketing strategies for the 2024/2025 season—we will cover it all.

In Part I of the series, we focus on the important starting points that can make or break your tire shop’s success: location and audience.

If you have any questions after reading this guide, please leave a comment below, and we’ll be sure to respond. And now, let’s begin by finding a location and clientele for your tire shop.

What is the best location for a tire shop?

PRO TIP: Since tires are a necessity for everyone, with smart marketing, virtually any area of the country has the potential for a successful, service-oriented tire business.

When determining the market & location of potential customers for tire shops, remember that a good geographic location can significantly impact your success! The Northeast is one of the top regions in the country to start a tire shop business. The other promising areas, in our opinion, are the Upper Midwest, the Mid-Atlantic states, Florida, and the West.

Maintain a professional website and ensure your tire business’s robust online presence. A comprehensive marketing plan, digital marketing campaigns, and smart marketing techniques are essential for staying competitive. And don’t forget local SEO! It’s vital for your tire shop to appear at the top of local search results!

Which market segment to choose when opening a tire shop?

PRO TIP: First-time small tire business owners can target passenger vehicle and commercial fleet operators as first clients.

Anyone who owns a car is a potential customer for a tire shop. The automotive industry and the tire business come together: vehicles and tires occasionally need to be serviced and replaced! However, “anyone” is too much of a broad target. You must define your typical customer profile as precisely as possible.

We recommend focusing on the passenger tire market first and expanding into the commercial segment after achieving some success. While it’s possible for a tire store entrepreneur to target both consumer and commercial segment customers, the customer base for heavy-duty trucks and buses is limited, well-established, and highly competitive.

You can realistically expect to attract clients like fleet owners from taxicab companies and delivery services. However, don’t expect to serve large companies like Bekins or Greyhound right away!

Partnering with local businesses, such as auto repair shops and tire dealerships, can enhance your marketing efforts and help you reach a broader customer base through mutual collaborations.

Potential customers and the cars they drive

PRO TIP: Your inventory and tire services depend on the demographic data of your target audience and, to a lesser extent, where they are located in the local community.

If your tire shop is located in Beverly Hills or Palm Beach, your clients are likely to drive Cadillacs, Mercedes, or Jaguars. In a middle-class suburb of Kansas City or Omaha, you’re more likely to serve Ford, Chevy, or moderately priced foreign car owners. If your shop is in a rural community where farming or ranching is a primary business, expect potential clients to drive pickups, four-wheelers, or vans.

Why is the exact location of your potential customer less critical? Even if your tire shop is situated in a more affordable part of town, with a professional website offering quality customer experience, proper advertising, smart marketing campaigns, and, of course, high-quality service, you can still draw customers from wealthier neighborhoods.

Now, let’s dive deeper and see how to choose the perfect location for your tire shop business.

Location, location, location!

PRO TIP: Location is an important factor in determining the success of a new tire shop, and in some cases, it’s the most important. Conducting a thorough market analysis is essential to determine the best location for your tire shop.

Studies have shown that a poor location is one of the leading causes of retail business failures. To succeed in retail, you must be willing to invest in a good location. Your location’s cost often correlates with your business’s volume and quality.

If you can secure a corner-of-the-street location, you’ll benefit from high visibility and easy access—both of which are critical for attracting customers. Your storefront has to be bright and attractive. And make sure your signage is visible from multiple directions, particularly from the intersections!

However, shop location may not be as critical for some retail businesses. If customers have a compelling reason to travel a longer distance, they will do so even if your shop is on the outskirts of town.

This is common among well-established tire dealerships. We’ve heard of customers driving 20 miles just to shop at a particular store. As recommended in this Guide, you can significantly increase your customer flow by positioning yourself strategically in the local market.

Types of potential locations

High-density business districts

PRO TIP: Understanding the business demographics and the region’s buying habits will significantly help you choose the perfect location for your tire shop.

Business districts speak success. Your potential customers work and have business meetings there. That’s why car brands choose to open showrooms in popular business districts. Besides locating your own shop, you can partner with local businesses—car dealerships and auto repair shops.

Residential business areas

PRO TIP: Your potential customers are more likely to use your tire services if your shop is conveniently located.

Consider locating your tire shop in a residential business area where customers can easily stop by. Understanding consumer behavior in residential business areas can help you determine the best location for your tire shop. Potential or existing customers will be able to visit your store while running errands or on their way to work. Remember, most people are unlikely to drive long distances just to reach a tire center!

Shopping areas

PRO TIP: Visiting shopping areas, people are in the mood to buy, and your tire store is more likely to attract customers.

For many businesses, especially small—to medium-volume tire shops—it often makes sense to locate in a small shopping center or a shopping district. A shopping center can increase foot traffic and attract more customers to your tire shop. However, always consider the presence of competitors! While two department stores or auto dealerships can often compete successfully side by side, this is usually not the case for two tire centers!

Nearby suburbs

PRO TIP: The nearby suburbs are likely to be occupied by homeowners with cars rather than renters.

However, areas with a high concentration of middle—to upper-middle-income apartment units are also attractive. Before finalizing a specific location or site, be sure to conduct a thorough market survey to gather customer data and understand market trends.

Zoning codes to consider

PRO TIP: Check the zoning codes of areas under consideration before investing significant time and money in a market survey or pursuing a specific site!

In nearly every city and town, areas as small as a few blocks or as large as many acres are zoned specifically for commercial, industrial, or residential development. Further zoning restrictions exist within these broad classifications. For example, a commercial zone may allow one type of business to operate but not another. Be sure to survey your community for potential locations.

The two major aspects of establishing a prosperous tire shop business

- Choosing a shop’s site

Nothing is more important than selecting the perfect location. Choose wisely and aim for a site that’s impossible to miss! - Properly targeting the local community

Local SEO is one of the most important marketing channels for a new tire shop. Incorporating targeted keywords related to tire sales in your pay-per-click (PPC) must be an important part of your marketing strategy. It will help to attract local customers and drive traffic to your website.

3 questions to ask yourself before choosing a shop’s site/community

- Is the population base large enough to support my tire shop?

- Does the community have a stable economic base that will foster a healthy environment for my business?

- Are the demographic characteristics compatible with the market I wish to serve?

How you weigh these considerations will depend on your specific business needs and goals.

1. What population do I really need to run a successful tire business?

PRO TIP: Studies show that a population base of at least 8,300 is typically needed to support a tire dealership, indicating the market potential of the area.

The United States Census of Business is a gigantic study that provides detailed information on the number of companies in each line of business and the populations of the communities where they are located. Your state’s own census of business can also be a valuable resource in this regard.

However, as mentioned earlier, it’s important to consider the presence of competitors in nearby areas before opening a tire shop.

2. Is the local community’s economic situation stable?

PRO TIP: A community’s economic indicators determine your business opportunities.

The wealth generated in or near a community significantly impacts local employment, income levels, and population growth.

People often move from one community to another in search of better employment opportunities and higher income prospects. A community’s occupational makeup depends on the types of jobs its resources and location can support, while its population density is influenced by the availability of these jobs. The nature and number of jobs largely determine the size and distribution of incomes among the community’s residents.

To evaluate a community’s economic base, gather the following information:

- The percentage of people employed full-time and the trend in employment

- The average family income

- The per-capita total annual sales for your goods

You can obtain this information by studying census data and other business statistics. Additionally, you can gain valuable insights into your prospective community by observing and listening to local residents.

Red light

- The necessity for high school and college graduates to leave town to find suitable employment

- The inability of other residents to find local jobs

- Declining retail sales and industrial production

- An apathetic attitude on the part of local business owners, educational administrators, and other residents

Greenlight

- The opening of chain- or department-store branches

- Branch plants of large industrial firms located in the community

- A progressive chamber of commerce and other civic organizations

- Good schools and public services

- Well-maintained business and residential premises

- Good transportation facilities to other parts of the country

- Construction activity, accompanied by a minimal number of vacant buildings and unoccupied houses for sale.

3. What potential customers’ demographic factors shall I consider?

PRO TIP: Income, occupation, education, culture, upbringing, and other factors strongly influence customers’ tastes and spending habits.

Understanding customer segmentation is essential when evaluating a community for your future tire shop. Professional business executives and their families differ from blue-collar workers in their purchasing interests and needs. A suburban clientele often differs from the environmentally conscious customers in a densely populated urban center. Families have different interests and needs than singles, and so on.

To determine if the community you are considering has a population with the demographic traits necessary to support your business, consider the following:

- Purchasing power (degree of disposable income)

- Residences (rented or owned houses, condos, or apartments)

- Places and kinds of work

- Means of transportation

- Age ranges

- Family status

- Leisure activities.

And what about future profits? Start with a market survey!

PRO TIP: A thorough market survey will help you to determine a reasonable sales forecast for your tire business.

Promoting tire maintenance and care services is a must when establishing your tire shop as an authority in the field. Here are the basic steps to assess your market and create a forecast:

- Determine the market limits or trading area.

- Study the population within this area to understand its potential spending characteristics. Targeted marketing and partnerships with auto repair shops can enhance visibility and generate referrals for tire services.

- Determine the area’s purchasing power.

- Determine the present sales volume of the type of services you will be offering.

- Estimate what proportion of the total sales volume you can reasonably capture.

Step 5 is particularly important. Opening a new tire store within a community doesn’t guarantee additional business volume; it may simply redistribute the existing business.

When conducting your market research, you’ll gather two types of data. The first is “primary” information that you compile yourself or hire someone to gather. Most of the information, however, will be “secondary,” meaning it’s already compiled and organized for you. Examples include reports and studies conducted by government agencies, trade associations, or other businesses in your industry. Seek out these resources and take full advantage of them.

Primary research and customer feedback

When conducting primary research, two types of information can be gathered: exploratory and specific. Gathering customer insights through surveys and direct communication is very important for improving your products and services. Satisfied customers can offer invaluable feedback and positive reviews that help enhance your offerings.

Exploratory research

In exploratory research, you define a problem by questioning targeted consumers with open-ended, general questions that elicit detailed responses.

Solving a particular problem with research

Specific research focuses on solving a problem that has already been defined. It typically involves more in-depth questioning than exploratory research. The objective of specific research is to identify concrete courses of action that will resolve a problem identified through exploratory research.

Using your own data

You can either hire a marketing agency to gather primary data or conduct primary research using your own resources. Start by deciding how you will question your target group—through direct mail, telemarketing, or personal interviews.

Direct email questionnaire

If you choose to use a direct mail questionnaire, make sure your questions are short and concise. Keeping your questions brief and to the point will increase the likelihood of receiving valuable marketing materials in the form of customer feedback.

Going old-school: telemarketing

The same considerations apply to telemarketing. Many people are bombarded with phone solicitations and have become wary of unfamiliar voices on the phone. This, combined with the fact that you are intruding on their personal time, often makes you an unwelcome caller. However, some people may still provide a small amount of their time to answer a few questions. Keep your questions concise, as being too verbose may lead to people hanging up.

Person-to-person interviews

One effective way to gather primary data is through person-to-person interviews. Once you’ve gained your customer’s attention and they’ve agreed to an interview, it becomes easier to sit down and ask questions that might take an hour or more to complete. The advantage of personal interviews over direct mail and telemarketing is that you’re not usually intruding on the individual’s personal time or space. Interviews are typically scheduled at a time convenient for the interviewee, and many interviewers offer incentives to participate, such as a small payment (e.g., $10) or a free gift. The key is that you’re dealing with a willing participant.

Customer reviews

One of the most valuable sources of data is your own customers’ reviews. Whether collected directly on your website, at marketplaces, or through your sales team, these opinions can really become a game changer. Analyzing them will give you a clear view of your business’s situation and provide numerous insights. Don’t underestimate this powerful tool!

Satisfied customers often leave positive reviews that can significantly enhance your business’s reputation and attract new customers.

Secondary research: forming a broader picture

Secondary research is less involved than primary research. It doesn’t require interviews to identify problems or develop courses of action. Instead, it relies on knowing where to find existing resources that have already gathered the necessary information.

Census tracts

Nearly every county government publishes population density and distribution figures in easily accessible census tracts. These tracts provide data on the number of people living in specific areas, such as precincts, water districts, or even 10-block neighborhoods. When developing marketing strategies for tire shops, consider both new and existing customers. Some counties also publish reports showing population data from 10 years ago, 5 years ago, and the present, offering insights into population trends.

Declining, static, or small populations generally do not support new businesses in an area. In contrast, increasing and expanding populations that are likely to need the services you offer are ideal. You must study the community’s lifestyle to determine if these residents are potential customers.

Maps of major trading areas

Market mapping of major trading areas in counties and states is available on the Federal Communications Commission website. These maps highlight each area’s primary businesses and the population’s spending habits. For the tire shop business, key aspects to consider include:

- Tire sales

- Tire maintenance services

- Strong online presence.

When assessing potential locations, also examine road maps to evaluate the ease of access to specific sites. Accessibility is a key factor in determining the limits of your market area.

Media research

Start by exploring the company’s website and blog. Next, review local magazines and websites to learn about the activities of tire shops in the area. Finally, check out their social media pages on platforms like Facebook, TikTok, Instagram, and others.

Visit Dun & Bradstreet to identify how many similar businesses are already operating and their locations. Compare the number of tire shops with statistics on the population base that can support them. Evaluate the reputation of existing businesses and their methods of operation through competitive analysis. Identify any gaps in the market or areas that could be improved—then offer more attractive services to win over customers!

Community organizations and local businesses

Major cities have chambers of commerce or business development departments that actively encourage new businesses to set up in their communities. These departments often provide valuable information—usually for free—on population trends, community income characteristics, payrolls, industrial development, and more.

Key industry players

The tire business is supported by various trade associations that conduct surveys on industry trends, market trends, and other relevant information, such as the Tire Retread Information Bureau, the National Tire Dealers, the Retread Tire Association, and, of course, the U.S. Tire Manufacturers Association. These organizations provide invaluable data on retail patterns and other insights that can help identify the types of customers you are likely to encounter before opening your shop.

This information is important for your marketing efforts, merchandising, and inventory decisions. Understanding what types of tires people are choosing in the broader market—based on factors like national advertising and regional climate needs—will help you make informed choices that align with customer demand.

Offering a diverse range of tire brands and services is important for attracting and retaining customers. Success in this industry hinges on innovative marketing strategies and strong customer service.

Car dealerships

Check out the automobile dealerships, both for new and used cars, in your area to gather sales data on the kinds of cars people are buying and in what volume. This information, which can offer valuable insights into the types of tires your customers will need, may be available from the dealerships themselves or, in some communities, from the chamber of commerce.

It’s essential to identify the industries in the area. Payrolls create the buying power of your potential customers. Without payroll stability and growth, investing in the area may be unwise. Ideally, you want to locate your business in a community with a substantial, diversified, and permanent industry base, an upward trend in payrolls, and minimal seasonality.

Forming a strong presence & product offering

PRO TIP: When targeting your markets, focus on highlighting the service and selection advantages of your tire store, distinguishing yourself from chain stores and large department stores like Walmart or Costco.

Utilize mixed-media marketing campaigns: well-crafted product descriptions on your website, engaging blog posts, active social media presence, direct mail, coupons, and cross-coupons. All these channels should be interconnected to create a cohesive and powerful brand presence in the market. You need to stand out! We recommend hiring a marketing specialist to help you develop a unique product offering that you can consistently promote in your campaigns.

Tire services? Only spot on!

PRO TIP: Loyal customers are the cornerstone of a successful business. Providing excellent customer service is a must for fostering positive, long-term relationships.

Remember, you’re not just selling tires—you’re selling service! This principle applies no matter where you’re located. We’ve heard of customers driving 20 miles just to visit a particular tire shop. As recommended in this Guide, you can significantly increase your customer flow by positioning yourself strategically in the local market.

Once you’ve built a solid reputation and established a loyal client base, showcasing customer testimonials will help build trust and enhance your brand’s reputation. Satisfied customers are more likely to leave valuable reviews that further elevate your shop’s standing. At United Tires, we take pride in having over 200,000 positive customer reviews.

What forms UTires customer loyalty?

- 24/7/365 friendly customer support. For us, the customer is always right. Our main goal is to make the buying experience as smooth as possible. A client can literally call us any time, day or night, and a representative from our support team will assist them in making the right choice or offer immediate help with a return or exchange.

- Affordable prices. Pricing strategy is a key component of business success in the tire industry. Understanding your competition and customer needs is essential to setting attractive prices that resonate with your audience.

- Customer convenience. Our tire shops are conveniently located and cozy and offer a comprehensive range of tire maintenance services and repairs. If you’re part of the Chicago local community, you can install and service your tires whenever it’s most convenient for you.

- Top-notch inventory management. We use smart tools and custom programs to manage our vast inventory.

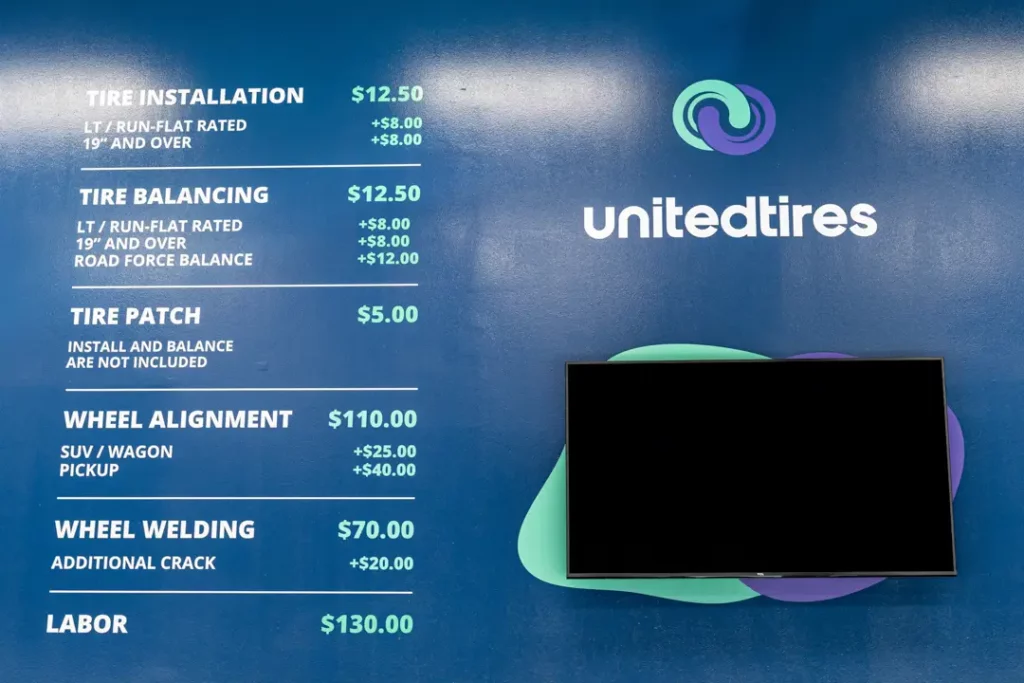

- A comprehensive range of tire services and top-of-the-line equipment. There’s nothing that can happen to a tire that we can’t fix! And our customers know it. They come to us to buy tires and for regular tire care: installation, tire rotation, alignment, TPMS diagnostics and repairs, wheel refinishing and powder coating, and much more!

- Strong online presence/online visibility. You can easily find us on the Internet, and our website offers a comfortable user experience. Vehicle owners appreciate this transparency, and it is definitely one of the most effective ways to boost sales in today’s competitive market. We publish articles with tire maintenance tips, using relevant keywords, and always assist customers with the optimal tire choice for their ride.

Frequently Asked Questions

How to choose the target audience for my tire shop?

We recommend beginning with a passenger tire retail business if you are just starting your entrepreneurship journey. The market for heavy-duty vehicles is more challenging, well-established, and highly competitive.

How to choose the best location for my tire shop?

Before choosing a location, consider the following questions:

- Is the population base of a potential spot large enough to support your tire shop?

- Does the community have a stable economic base that will foster a healthy environment for your business?

- Are the demographic characteristics compatible with the market you wish to serve?

- How many competitors are located in this area, and what are their strengths and weaknesses?

What are the types of locations for opening a tire store?

Consider high-density business districts, residential business areas, and nearby suburbs. After gathering basic information about your target audience and answering the key questions when choosing a location, you’ll have a clearer understanding of which type of location to choose. Don’t forget to consider zoning codes and explore all available information on business operations online!

What role does competition play in selecting a location for my tire shop?

Competition is a significant factor in selecting your location. While being near competitors can sometimes be beneficial—by attracting customers who are already shopping for tires—too much competition in a small area can limit your market share. Analyze the strengths and weaknesses of nearby competitors to determine if you can offer something unique that will attract customers.

Share the Knowledge