Last Updated on 12.09.2024 by hrushetskyy

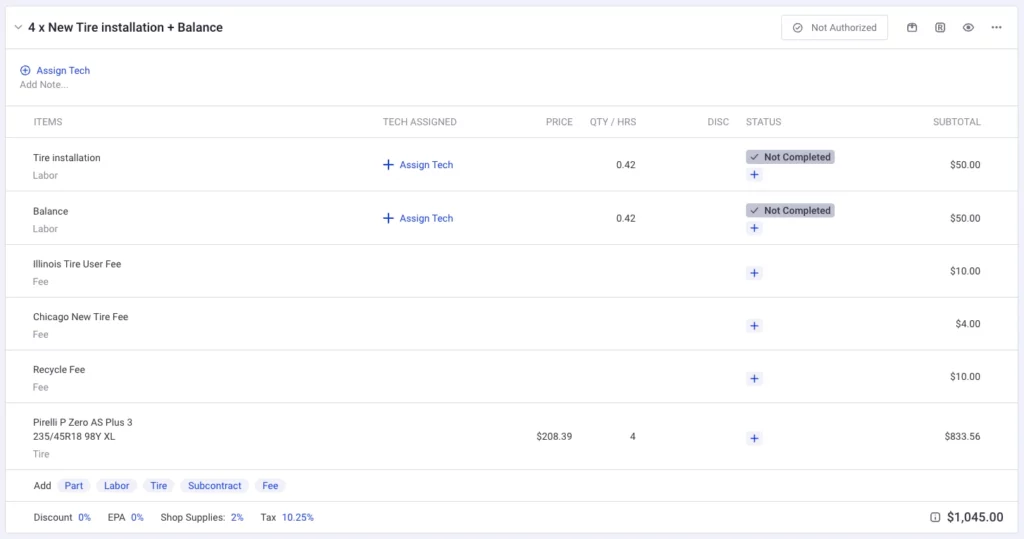

As a tire buyer, you may face two extra charges added to the tire price. The tire disposal fee directly funds scrapping end-of-use tires, and the waste tire fee supports recycling initiatives and programs in your state. Let’s clarify the confusion and define each fee. Hopefully, after reading this article, you’ll understand the big impact of this little contribution of yours and learn how to recycle tires in the best possible way.

State tire fee vs tire disposal fee: what’s the difference?

The state tire fee is a mandatory charge that supports recycling initiatives of a particular jurisdiction and is always added to the tire price (unless exempted by the state).

While not mandatory, some tire shops/installers might add a disposal fee to your bill. This fee helps cover the costs of transporting used tires for proper recycling.

Both are added over the sales tax.

State tire fee explained

Once bought or brought into the state, a tire will be recycled when it reaches its lifespan. But how? This depends on the state’s government, its recycling programs, and the waste tire fees it collects.

Added to the price of each tire upon checkout, this fee doesn’t directly pay for the physical disposal of a particular tire. It rather supports all the initiatives and tire recycling programs developed by the state. Whether used tires will be transformed into the playgrounds’ surface, become rubberized asphalt, or turn into fuel depends on the particular state’s recycling practices.

Levied by each state individually, the fee ranges between $0,25 to $2 per “regular” tire, with larger tires sometimes carrying heavier fees (for example, $10 per one off-road tire in Louisiana). In most states, it’s applied to new tires, but some require it for used tire sales, too.

At United Tires, we collect the fee upon an order’s checkout and forward it to the Department of Revenue of a destination state. It then distributes the funds to the state’s Department of Natural Resources.

This little contribution from our customers is huge for the environment! It reduces reliance on virgin resources, contributes to conscious consumption, and allows the development of impressive recycling initiatives.

State tire fee: other names

State tire fee comes under many names, dependent on the state:

- Waste tire fee

- Waste tire management fee

- Environmental fee

- Tire user fee

- Scrap tire disposal tax

- Scrap tire environmental fee

- New waste tire fee

- New tire fee

- Rire excise tax

- Rim removal fee

- Tire pre-disposal fee

- Replacement tire fee

State-by-state waste tire fees

Fee per 1 tire sold

| List of State Tire Fees by State | |

|---|---|

| State | Fee per New Tire Sold |

| Alabama | $1 per tire |

| Alaska | $2.50 for each new tire, and an additional $5 for each studded tire ($7.50 total tire fee for new studded tires) |

| Arizona | 2% of the retail price of the tire, up to $2 per tire. $1 per tire for new vehicles (where the price of the tires is not listed separately on the invoice) |

| Arkansas | $3 per new car tire, $1 per used car tire |

| California | $0.75 per tire |

| Colorado | $1.75 per tire |

| Connecticut | $2 per tire |

| Delaware | $2 per tire |

| Florida | $1 per tire |

| Georgia | $1 per tire |

| Hawaii | $1 surcharge per tire imported to the state, paid by importers |

| Idaho | None (illegal dumping subject to $500 fine) |

| Illinois | $2.50 per tire |

| Indiana | $0.25 per tire |

| Iowa | No scrap tire fee or fund |

| Kansas | $0.25 per tire |

| Kentucky | $2 per tire |

| Louisiana | $2 per tire weighing less than 100 pounds, $5 per tire for each medium truck tire, and $10 per tire for each off-road tire |

| Maine | $1 per tire |

| Maryland | $0.80 per tire |

| Massachusetts | No scrap tire fee or fund |

| Michigan | Scrap Tire Program is funded by a $1.50 vehicle title transfer fee |

| Minnesota | No scrap tire fee or fund |

| Mississippi | $1 per tire with a rim size less than 24 inches and $2 per tire with a rim size greater than 24 inches |

| Missouri | $0.50 per tire |

| Montana | No scrap tire fee or fund |

| Nebraska | $1 per tire |

| Nevada | $1 per tire |

| New Hampshire | No scrap tire fee or fund, but towns can collect a fee upon vehicle registration and may use the revenue from this fee for off-site scrap tire management |

| New Jersey | $1.50 per tire |

| New Mexico | $1.50 per tire |

| New York | $2.50 per tire |

| North Carolina | 2% disposal tax on the total cost of the tire with a rim size of 19.5 inches or less1% disposal tax on the total cost of the tire with a rim size of more than 19.5 inches |

| North Dakota | No scrap tire fee or fund |

| Ohio | $1 per tire |

| Oklahoma | $2.90 per tire with a rim size between 17.5 & 19.5 inches and $5.50 per tire with a rim size greater than 19.5 inches |

| Oregon | No scrap tire fee or fund |

| Pennsylvania | $1 per tire |

| Rhode Island | $1 per tire |

| South Carolina | $2 per tire |

| South Dakota | $0.25 per tire |

| Tennessee | $1.35 per tire |

| Texas | No scrap tire fee or fund |

| Utah | $1 per tire |

| Vermont | No scrap tire fee or fund |

| Virginia | $2 per tire (from 07/01/24) |

| Washington | $1 per tire |

| West Virginia | No set scrap tire fee, but from 07/01/24, all dealers must collect a tire disposal fee at the purchase of new tires |

| Wisconsin | No scrap tire fee or fund |

| Wyoming | No scrap tire fee or fund |

Can I skip paying a state tire fee?

If you are a direct consumer, most likely, no. However, different states have different rules for types of tire purchases/entities exempted from paying a mandatory state tire fee.

For example, in New York, organizations like the United States/New York State agencies and instrumentalities, the United Nations and other international organizations, Native American nations, or tribes residing in New York state are exempt from paying the fee.

Louisiana “does not require the collection of fees on the sale of tires weighing 500 lbs or more, solid tires, or tires which are de minimis in nature, including but not limited to lawn mower tires, bicycle tires, and golf cart tires”.

Check your state’s Department of Revenue or Natural Resources websites for more information.

Tire disposal fee

The tire disposal fee covers the costs of an end-of-life tire’s physical disposal at specialized recycling facilities. This fee can be charged by the tire retailer/installer/city. The charge depends on a particular entity and is fixed for different types of tires.

For example, in Madison, WI, you’ll have to pay $5 and $10 per tire on a rim for a waste tire management disposal service to take your old tires and bring them to a tire recycling facility for disposal.

Some states don’t have state tire fees but mandate tire retailers collect tire disposal fees upon new tire sales.

How to avoid a tire disposal fee?

If you don’t want to pay the shop/installer when buying new tires, you can usually collect your old ones and bring them to the nearest recycling facility.

What stands behind the tire disposal fee: tires as an environmental hazard

Tire, tire, pants on fire

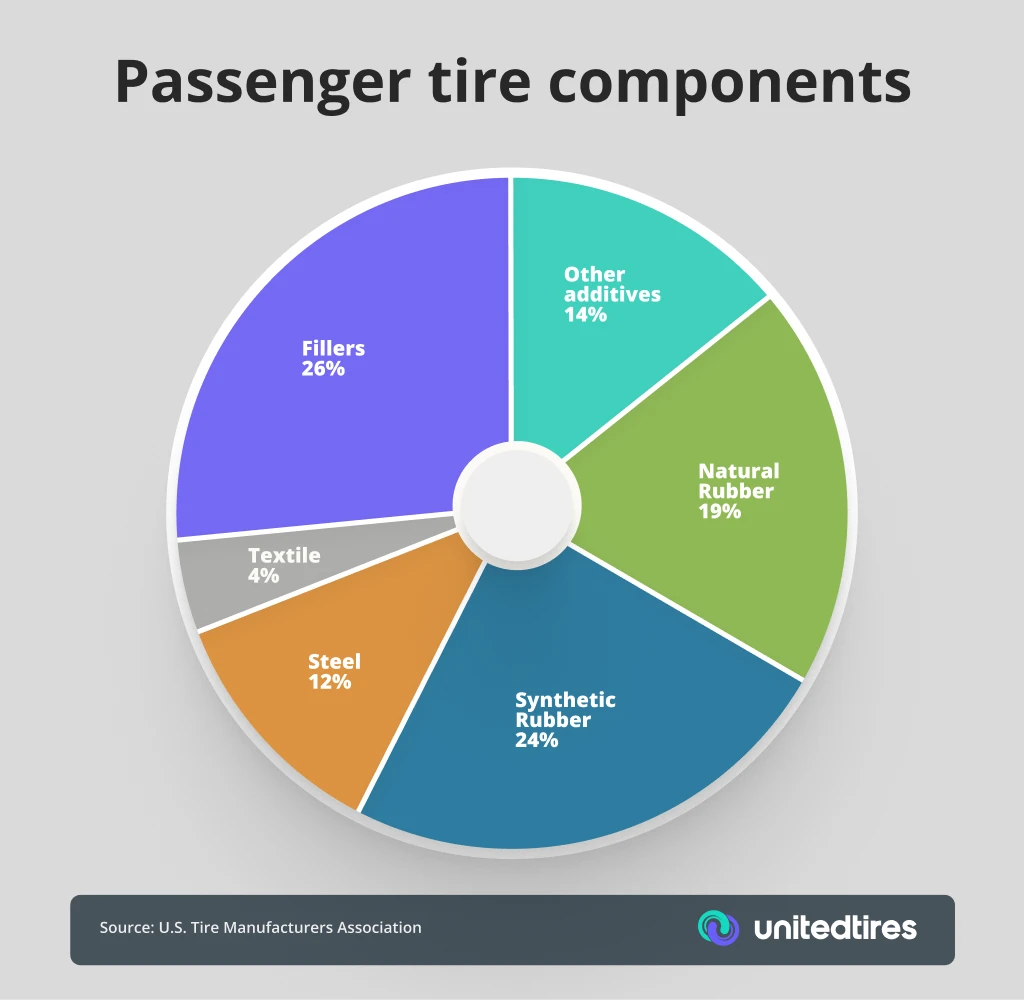

Tires are a dangerous waste—their components (about 20% natural and 24% synthetic rubber) take about 80 years or longer to decompose.

Accumulated in landfills, tires pose environmental hazards, including harmful methane gas release. When a stack of tires catches fire, it becomes uncontrollable and emits thick, black smoke and toxic chemicals. Tire fires are notoriously difficult to extinguish. They cause severe pollution and health hazards for firefighters and residents of the nearby areas. Plus, tire stockpiles are also ideal breeding grounds for mosquitoes. According to the Illinois Environmental Protection Agency, only one single scrap tire discarded in a damp area can generate tens of thousands of disease-carrying mosquitoes.

Even at the recycling facilities, tires emit toxic aromatic hydrocarbons (naphthalene and benzene) when burned down in incinerators.

The number of annually discarded tires in the U.S. reaches 300+ million (and 1 billion globally). If the problem of stockpiles hadn’t been addressed, old rubber would have destroyed the ecology and marred the beauty of our neighborhoods.

That was (almost) the case until recently. The famous tire fire of 1983 in Rhinehart, Virginia, lasted nine months. Seven million tires burned slowly, emitting lead and arsenic into the air. It took 19 years to clean the area up completely.

You don’t want anything like that anywhere near your kids, right?

“Only 50 million more stockpiled tires still to go”

Thanks to the rapid development of the tire recycling industry, including the initiatives of the U.S. Tire Manufacturers Association (USTMA) under the auspices of the Scrap Tire Management Council, the situation has drastically improved in recent decades.

According to the “2021 US Scrap Tire Management Summary” by USTMA, “In 1990, about a billion scrap tires were in stockpiles in the U.S. By 2021, over 95% of those tires have been cleaned up! Only 50 million more stockpiled tires still to go.”

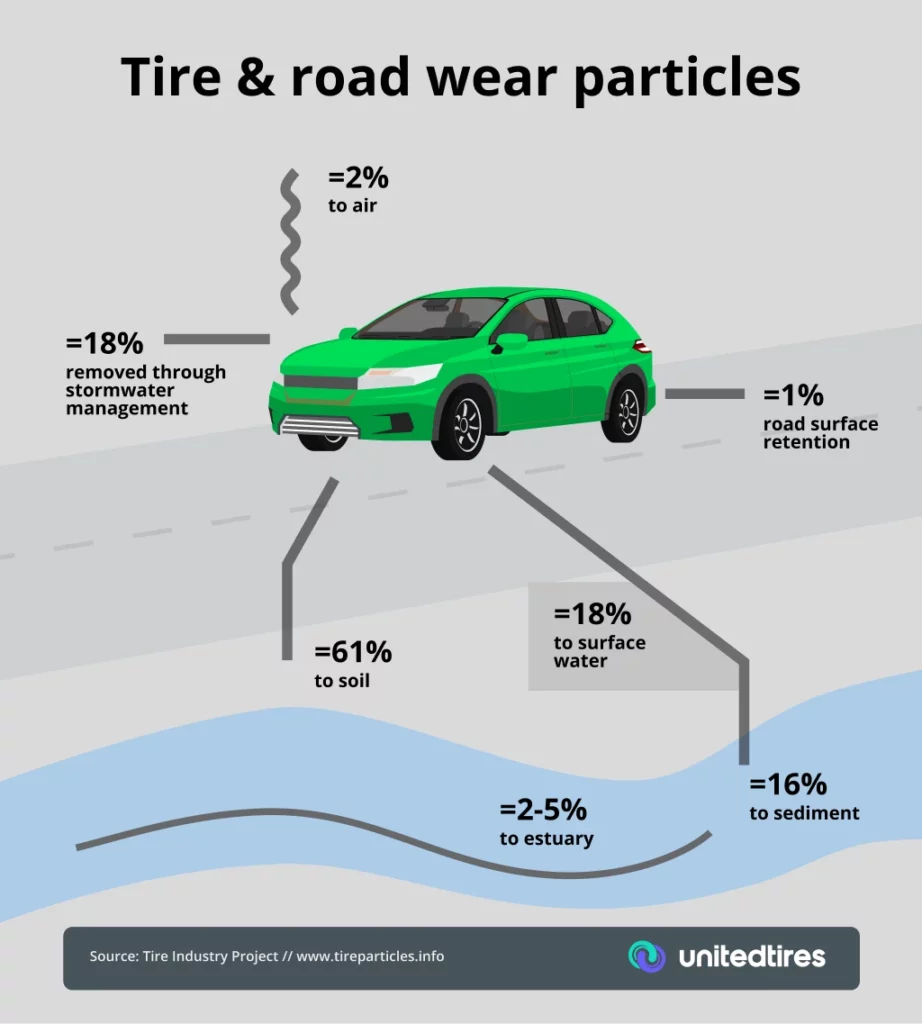

Invisible particles & Tire Industry Project

Tires pollute the environment in invisible ways, contaminating water and air while on the road.

A big issue is road wear particles caused by braking. Yale School of Environment sites: “According to Emissions Analytics, cars in the U.S. emit, on average, 5 pounds of tire particles a year.” That tire waste can enter waterways, lakes, ponds, and the ocean.

According to the British “Guardian,” air pollution from particles produced by tire wear can be 2,000 times more harmful than car exhaust fumes.

The industry is close to regulating emissions from tires and brakes, not only tailpipe. For example, The California Department of Toxic Substances Control (DTSC) required tire manufacturers to offer an alternative to a harmful tire compound 6PPD (and 6PPD-q) in 2024.

In 2005, the ten largest tire manufacturers, under the umbrella of the World Business Council for Sustainable Development (WBCSD), founded the Tire Industry Project. This project addresses the issue of end-of-use tires and the pollution caused by tires in use. Besides other studies and programs, it involves researching tire compounds emitting dangerous chemicals into the air.

Names standing behind the tire recycling initiatives speak for themselves.

10 members of the Tire Industry Project

- Bridgestone

- Michelin

- Continental

- Pirelli

- Goodyear

- Sumitomo

- Hankook

- Toyo Tires

- Kumho Tire

- Yokohama

Paying tire disposal fees and state tire taxes is your personal contribution to sustainable tire production and stockpile remediation. Now, let’s see how to recycle tires.

How to recycle tires?

If you’re asking, “How to recycle tires?” the answer isn’t so complicated. There are a few convenient ways to recycle tires (besides kids’ swings), and we list all of them here.

1. Contact a tire disposal service

Contact a tire disposal service to pick up your old tires and take them to a recycling center. You may have to pay a recycling fee for your tires to be picked up and hauled.

2. Drop them off at a local tire scrap recycling center

Visit a tire recycling center yourself and drop off your used tires. Waste tire recycling fees may be applied. You can find your local tire scrap recycling center at Earth911. Dial 1-800-CLEANUP, or search by the material you recycle and enter your ZIP code.

These collection sites typically require permits to operate. Some states restrict the height of each tire stockpile, the distance between them, drainage conditions, and the distance from property lines.

3. Sell your old tires

Rather than hauling your old tires to a landfill, you can offer your vehicle tires for resale if the rubber and tread are still in good condition. There are a few ways, including:

- Contact your local tire retailers. Many tire dealers sell used tires that still have life; some deal exclusively in pre-owned tires.

- Look for retreading facilities or shops. Remolded tires can be up to 40% cheaper than new tires, plus they require much less oil than new tires, making them environmentally friendly. In addition to turning your old tires in at such a shop, purchasing retread or remolded tires can be a means of helping the environment.

- Visit online marketplaces such as eBay, American Classifieds, and Craigslist to set a price and advertise your used tires for sale.

4. Pay the disposal fee when purchasing new tires

If you buy a new set of tires from a tire dealer, expect to pay a state tire fee and a tire disposal fee, which fund the state’s recycling initiatives and cover the cost of tire disposal services that take care of your old tires.

5. Spread the word about recycling

Tell your friends, family, and co-workers how to recycle tires and how easy it is to participate in recycling programs. Share the knowledge of the harmful impact of waste tires on the environment that you’ve learned from this article!

6. Shop green!

When buying new tires, consider tire brands/shops participating in the recycling initiatives. This helps the industry grow and keeps tires out of landfills. It’s a win-win for your car and the environment.

Reduce, reuse, recycle: the circular tire economy’s ripple effect

Remember those childhood tire swings and innertube sleds? That’s just the tip of the iceberg when it comes to tire recycling. The ultimate goal? A circular tire economy, when used tires get a new life as new tires and other products, minimizes waste and maximizes resource efficiency.

Ok, you paid your tire disposal fee or/and state tire tax. Now, those funds are used to ship used tires to a commercial reprocessing plant. There, they’ll be broken down into valuable materials.

Industry leader Genan, with its massive Houston, Texas facility (the largest tire recycling plant in the world!), is a great example of how these plants give end-of-life tires a remarkable second life.

Let’s see what products can be produced from recycled rubber.

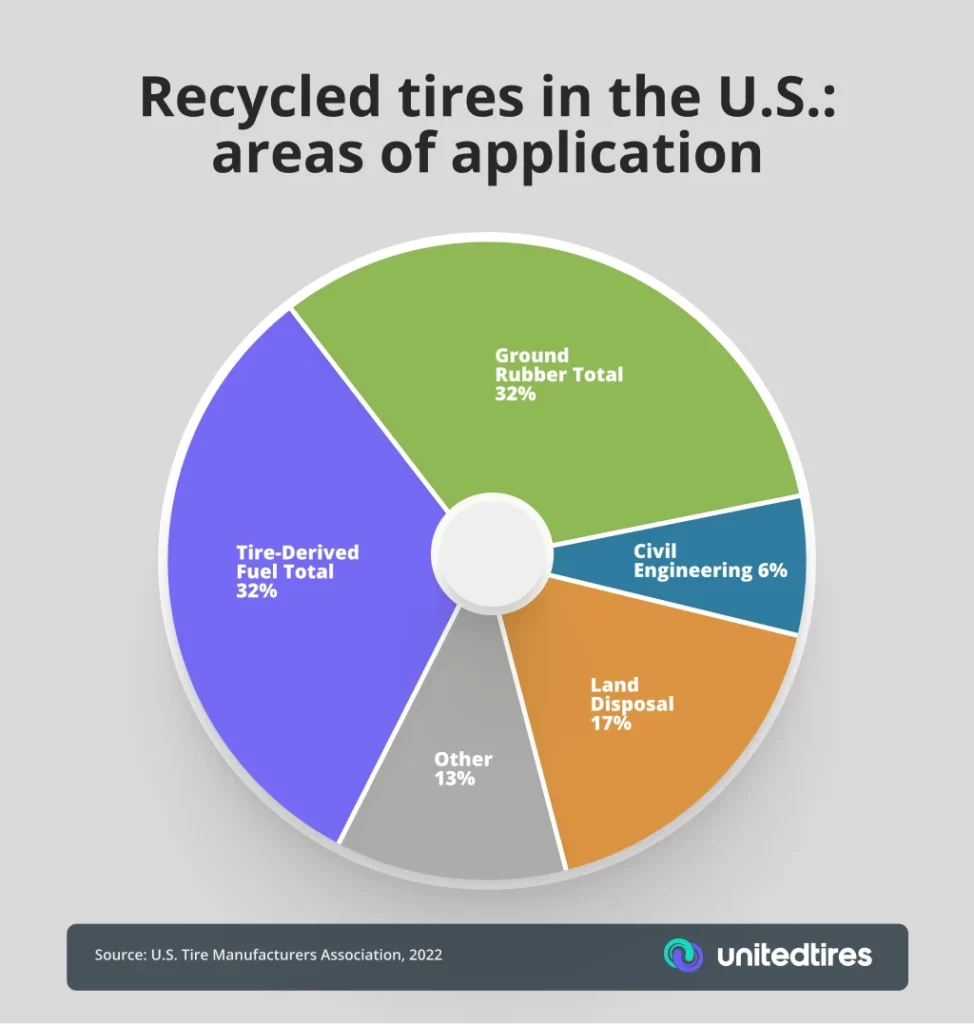

According to the “2021 US Scrap Tire Management Summary” by USTA, in 2021, 32% of recycled rubber in the United States was turned into tire-derived fuel, 32% became “ground rubber” (all sorts of rubberized surfaces), 17% went for land disposal, 6%—to civil engineering and 13% to other uses.

Ground rubber applications

- Sports surfaces (football fields with artificial turf, running tracks)

- Playground surfaces

- Rubberized asphalt

- Automotive industry

- Highway crush barriers

- Paint, binding agents, coating

- Mats, floors, tiles, noise reduction solutions

- Footwear,

Tire-derived fuel applications

- Cement kilns

- Pulp and paper

- Dedicated tires-to-energy

- Lime kilns

- Industrial boilers and electric utilities

Tire recycling isn’t just about keeping old tires out of landfills. It fuels our communities. Using recycled materials, the industry creates manufacturing jobs, stimulates local economies, and reduces production costs. Tire-derived fuel, a sustainable alternative for energy-intensive industries, burns 25% hotter than coal.

Frequently Asked Questions

How much is a tire disposal fee?

Depends on who collects it. The tire disposal fee funds the direct disposal of end-of-use tires and can be charged by the tire retailer/installer/town. Usually, it’s between $2 and $5 per regular-sized tire.

Do I have to pay tire disposal fee?

If the state mandates tire dealers to collect it, then no. In other cases, if you don’t want to pay a tire disposal fee, you can take your old tires to the recycling facility yourself (and pay directly there).

How much is a waste tire fee?

That depends on the state you live in. The price for regular-sized tires varies from $0.25 to $2 per tire. Some states don’t mandate tire disposal fees.

What states don’t have waste tire fees?

Currently, 12 states don’t charge waste tire fees:

- Iowa

- Massachusetts

- Minnesota

- Montana

- New Hampshire

- North Dakota

- Oregon

- Texas

- Vermont

- West Virginia

- Wisconsin

- Wyoming

However, this doesn’t mean you will avoid a tire disposal fee—a charge set by a tire retailer/dealer/installer directed for scrapping end-of-use tires.

I’m in NY, buying tires from your warehouse in IL. Which state’s fee do I pay?

You’ll pay the waste tire fee of New York state, $2.50 per tire. The tires that we ship from the United Tires warehouse to New York will be recycled in New York. You bring tires into the state. Therefore, you pay the waste tire fee set by your state.